The world price of coffee has become a signal of complexity, not stability. Global forces influence every dollar in a roaster’s ledger, and the journey of each bean reflects climate, politics, logistics, and long-term scarcity. This is a moment to trade confusion for clarity and to examine what quality, value, and consistency truly mean.

The World Price That Shapes Every Conversation

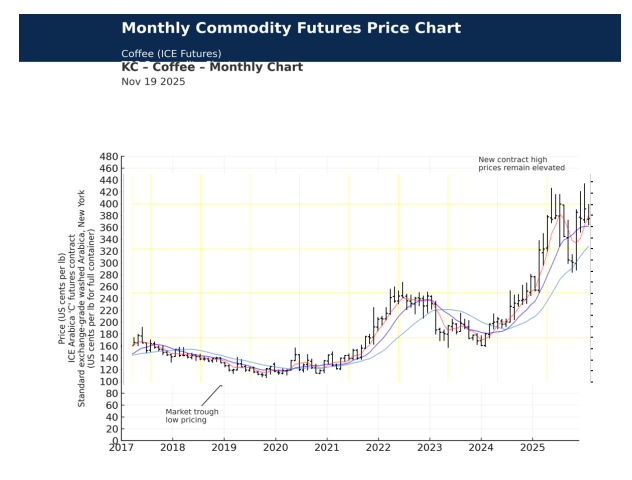

Anyone who works with coffee is familiar with ICE, the commodity index that anchors global pricing. Today it sits near 4.16 USD. What looks like a single number is actually the centre of a highly reactive system that has risen sharply over recent years and continues to oscillate with each new climate report, political shift, or supply shock.

ICE is the baseline. Quality differentials, origin, delivery timelines, and lot size exist above it. A roaster deciding between unroasted green coffee beans, or a buyer comparing mid-range offerings, is ultimately navigating the distance between ICE and the unique attributes that make one source stand apart from another.

The past few seasons have shown how quickly the baseline can transform. The rise in ICE has not only elevated costs, it has reshaped expectations across the supply chain.

Climate, Conflict, and the Slow Creep of Scarcity

Coffee is sensitive, even fragile, when facing a warming world. Unpredictable rainfall, prolonged heat, and disease cycles have compressed yields in major coffee-growing regions. At the same time, geopolitical instability has added layers of pressure. Tariffs, conflicts, fuel inflation, and disrupted transport networks accelerate costs that were already rising due to environmental stress.

Brazil’s exposure to US tariffs, some nearing fifty percent, creates a cascading effect that ultimately alters global dynamics for Colombian producers. Even those who are not directly targeted feel the weight of a disrupted equilibrium.

One of the subtler factors shaping the current landscape is the state of world reserves. Years of elevated prices have discouraged stockpiling. Inventories are now low, and this lack of buffer means every disturbance, no matter how small, has an amplified effect.

This is why prices behave less like a stable staircase and more like a fault line under tension.

Canada’s Position in a Shifting Tariff Landscape

Amid these global forces, Canadian importers occupy a unique position. Because shipments arrive directly from Colombia, and sometimes Africa, the uncertainty of US tariff policy does not apply. It removes a significant layer of unpredictability and keeps the cost structure closer to true origin conditions rather than geopolitical distortion.

Container-scale logistics also shape strategy. There are no roads from Colombia to North America, so marine transport governs both timing and quantity. This reality forces discipline. It encourages tight margins, deliberate buying windows, and a sensitivity to how price adjustments affect roasters.

When the world price surges, the instinct might be to pass this cost along immediately. Yet when inventory is strong, delaying a price increase becomes an act of partnership, not sacrifice. Holding prices for months at a time, even when replacement stock would cost more, is a choice made with long-term stability in mind.

Inventory Strategy and the Real Cost of Patience

In commodity markets, timing is often viewed as speculation. Here it is something more grounded. With healthy inventory, a company can hold the line while waiting for better conditions. It is a form of buffering that protects customers who work at scale.

This patience is not indefinite. When new shipments arrive at a higher world price, the adjustment becomes unavoidable. But the philosophy remains the same. Softening increases, delaying them when possible, and preparing customers long before changes take effect helps ensure continuity for businesses that rely on predictable inputs.

For roasters in Ontario and across Canada, value comes from more than the price per kilogram. It arises from consistency, reliability, and the knowledge that increases are driven by global reality rather than opportunistic markup.

Understanding the Coffee Value Pyramid

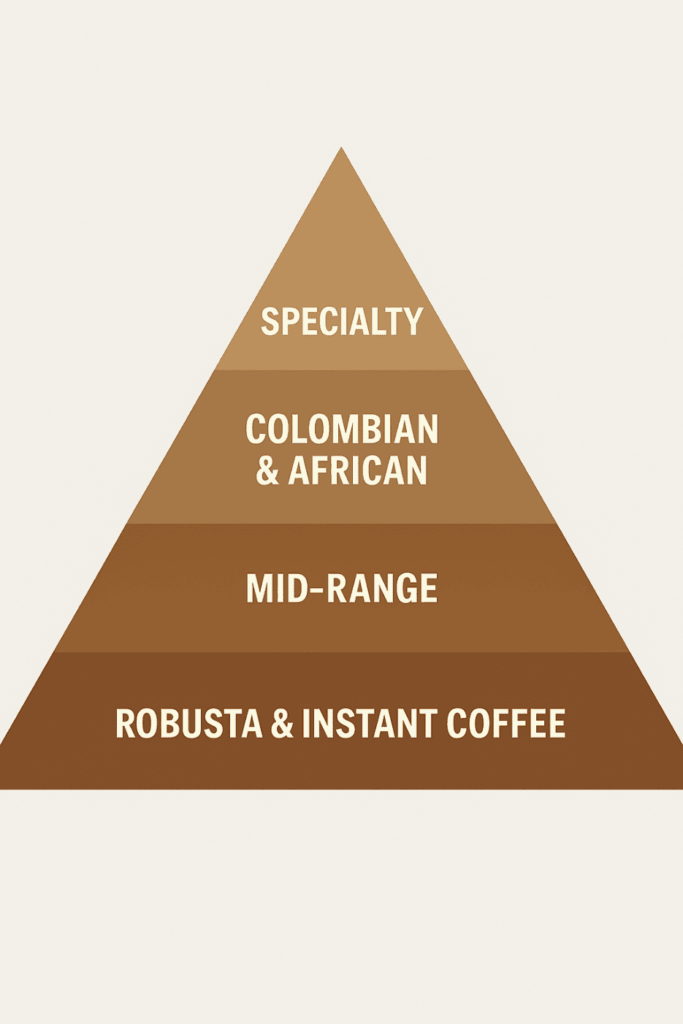

Ralf’s framing of a value pyramid offers a visual way to understand how the market organizes itself. At the base sit robusta and a range of instant coffees. These products offer volume and affordability but limited sensory expression.

As one moves upward, the pyramid becomes narrower and more intentional.

Mid-range Arabicas, refined Colombians, and certain African origins form a centre anchored in quality and consistency. This is the space where careful roasters operate, balancing flavour integrity with financial feasibility.

Above this, one finds the small-lot micro-regional offerings, processing innovations, and prize-winning elaborations that push the boundaries of what coffee can be. These coffees are not everyday purchases. They are designed for exploration, learning, and the occasional indulgence that reminds us why the craft matters.

Most buyers will not live at the top of the pyramid, nor should they. The goal is not to ascend permanently, it is to understand the structure so that each purchase is intentional.

When a roaster chooses an affordable premium coffee wholesale line or evaluates specialty suppliers, they are essentially choosing where on the pyramid they want to operate and how often they want to climb higher.

Choosing Quality with Intention

There is value in exploring the upper tiers occasionally, not to chase prestige but to reconnect with the craft. It aligns with a sentiment expressed by Steve Chin in Penang: a cup of coffee becomes a metaphor for measured living, a reminder to follow one’s own path rather than the pace of others.

Quality, like success, is not a race. It is a choice made repeatedly and quietly.

For companies that operate in the mid and specialty ranges, Colombian offerings represent a sweet spot. They provide reliability, nuanced flavour, and a level of consistency that justifies the price. This is where the pyramid’s promise becomes real.

Our role, as importers and partners, is to ensure that value stays accessible even when the world price climbs. Tight margins, patient inventory strategy, and transparent communication help sustain that commitment.

Rewind

In a world where the commodity index moves like a restless tide, clarity becomes a form of service. Understanding the forces that drive price, the origins of volatility, and the structure of the value pyramid allows roasters to navigate uncertainty with confidence.

The cup in hand is more than a beverage. It is the final expression of climate, trade, logistics, patience, and intention. And when chosen well, it reflects not only quality but also the quiet contentment of someone who knows exactly why they picked it.

FAQs

- Why has the global coffee price remained so high in recent years?

Elevated ICE prices reflect climate pressures, low world inventories, geopolitical instability, and rising costs for fuel and transport. These structural factors keep the baseline high and volatile. - How do tariffs affect coffee prices?

Tariffs reshape the competitive landscape. For example, US tariffs on Brazilian coffee redirect demand flows and disrupt global balance, which has indirect effects even on origins that are not taxed. - Why can Canada avoid some of this volatility?

Direct imports from Colombia bypass US tariff policy. This allows Canadian suppliers to maintain greater pricing stability and base their adjustments on true origin costs rather than imposed fees. - What is the value pyramid in coffee?

It is a framework that categorizes coffee by quality: robustas and instant coffees at the base, mid-range Colombians and African origins in the centre, and small-lot specialty and prize-winning coffees at the top. - Why delay price increases when world prices rise?

With strong inventory, delaying increases protects roasters by smoothing the impact of global volatility. Price adjustments still become necessary, but they are implemented more gradually. - How should roasters navigate the current market?

By focusing on consistency, understanding where they want to sit on the value pyramid, and choosing suppliers that prioritise transparency, quality, and long-term stability.